Discover Your Development Destination

Unveiling Opportunities in Kandiyohi County

Start your development journey with confidence! As a developer or site selector, you deserve more than just a location — you need a strategic partner. At Kandiyohi County Economic Development, we offer tailored solutions that provide you with strategic insights, streamlined processes, in-depth knowledge about incentive programs, valuable introductions to key partners, and seamless access to the latest data and research.

Discover Kandiyohi County's vibrant communities and businesses by exploring our partners, the City of Willmar, with whom we share our joint powers agreement with, Willmar Lakes Area Visitor and Convention Bureau , and the Willmar Area Chamber of Commerce.

Introducing Kandiyohi County

West Central Regional Hub

Willmar is the regional center for both Kandiyohi County and West Central Minnesota, offering employment opportunities for a much larger area than Kandiyohi County’s geographic borders. The following data represents the six counties that make up the West Central Regional Hub: Chippewa, Meeker, Pope, Renville, Swift and Kandiyohi.

Education

Source: U.S. Census Bureau, 2018-2022 American Community Survey (5-Year Estimates)

Employment

Employment Statics for March 2024. Find monthly data from the Minnesota Department of Employment and Economic Development.

Transportation

Willmar and Kandiyohi County provide a comprehensive transportation network to keep your goods and services moving. The transportation infrastructure includes a medley of highway connections providing north/south connections via US Highway 71 and MN Highway 23 and east/west connections on US Highway 12 and MN Highway 40.

The Burlington Northern Santa Fe (BNSF) Railway, a Class 1 rail system, is critical to our success as a regional business hub. BNSF has a significant presence in Willmar, featuring an east/west and north/south connection on Minnesota’s busiest railway.

A $10 million Transportation Investment Generating Economic Recovery (TIGER) Grant awarded by the U.S. Department of Transportation was used in a $52 million collaborative public-private project to construct approximately 14,500 feet of track between two BNSF main lines and bypass train traffic west of Willmar. A private rail services company, based in Lexington, KY, has acquired 144 acres of city property to develop a rail park offering a variety of rail services.

As a regional trade center for West Central Minnesota, one of the critical elements in the city of Willmar's plans was enhanced freight connectivity for industrial development. The $48 million Willmar Wye rail project provided access between the Morris and Marshall subdivisions west of Willmar. The Willmar Bypass will reduce rail traffic congestion through the City of Willmar and provide efficiencies for rail users. With this rail project, the Willmar Industrial Park will be served by all three major freight modes—air, rail, and trucking.

The Willmar Industrial Park is located to the west of the City of Willmar’s Renaissance/Opportunity Zones (RZ/OZ). The new FedEx Ground Distribution Center is a regional draw for trucking transportation. Highway 71 goes through the Willmar RZ/OZ and connects with two major highways, US Highway 12 and MN Highway 23.

The City of Willmar boasts several transportation/logistics businesses, including Mills Auto Parts, UPS, Northern Radiator, Woody’s Trucking, Magnum Trucking, and 6th Street Logistics, among other strong businesses.

Suppose air travel and cargo are important to your company. In that case, you’ll appreciate the quality of the facilities at the Willmar Municipal Airport, with an all-weather 5,500-foot runway that safely accommodates all business jets and most cargo planes.

In the spring of 2022 the City of Willmar approved the construction of a new hangar that accommodates the largest corporate jets currently on the market at the Municipal Airport. It sufficiently accommodates business jets and cargo planes with the paved 5,500-foot runway. Airport travelers have access to a full-service, fixed-base operator without the congestion of a metro airport.

Kandiyohi County’s local transit services and public transportation systems are integral parts of the community’s transportation system, transporting significant numbers of people and offering mobility to individuals without other personal transportation options.

Central Community Transit (CCT), provides a number of transportation services to the region’s residents, including public transportation for a fee.

Jefferson Bus Lines has daily scheduled service from Willmar to Sioux Falls and the Twin Cities. Willmar’s stop location is at the Lakeview Inn. Tickets are available online, in person at the Lakeview Inn or by calling 800.451.5333.

Kandiyohi County also has private charter bus companies, including R & J Tours and Southwest Tours and Willmar Bus Service.

Willmar Industrial Park

The Willmar Industrial is one of only 38 certified shovel-ready by the Department of Employment and Economic Development (DEED), which means planning, zoning, surveys, title work, environmental studies, soils analysis and infrastructure engineering are complete to start construction.

Highlights of the Industrial Park include:

- Easy access to U.S. Highway 12, 71 and MN Highway 23

- Access to the airport and tier 1 rail, including the Willmar Wye

- One of only 33 shovel-ready industrial parks in Minnesota

- Roads, water, sewer and stormwater infrastructure in place

- The latest construction includes a 217,000 sq. ft. $30 million FedEx Ground distribution center completed in 2022

- New wastewater treatment plant with 1.5 million GPD sewer capacity

- Near 28 MW (with 14 MW available capacity) electrical substation, 69 KV overhead line, 12 KV buried distribution line and 5-8 MW transmission available

- Access to 6-inch natural gas line with 55 - 60 PSI

- Ridgewater Community College and its customized training services is located 2 miles from the park

Opportunity & Renaissance Zone Development

Be Part of Willmar's Growth

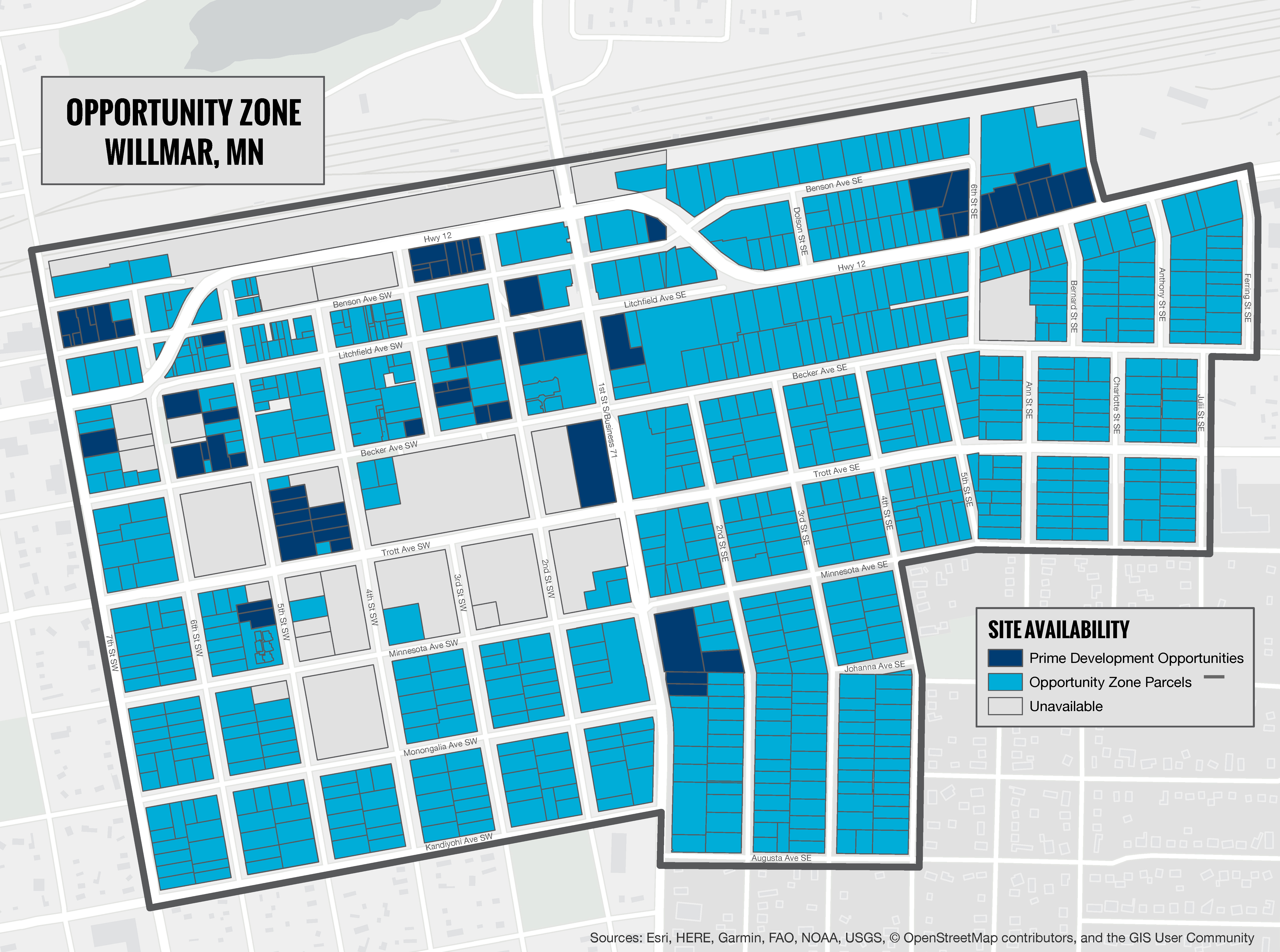

Successful Opportunity Zone development will increase economic growth, security and mobility for all Willmar residents and reduce racial wealth gaps. Developers, builders, and investors will have equal access to opportunities in the zone. The Opportunity Zone drives investments that foster mixed-income housing, affordability, and security for families most at risk of displacement, including low-income households and households with new Americans. Investments are expected to drive equitable growth and prosperity for current low-income residents and communities of new Americans within the zone. Community groups and leaders continue to intentionally pursue equity throughout all facets of life in the Willmar area.

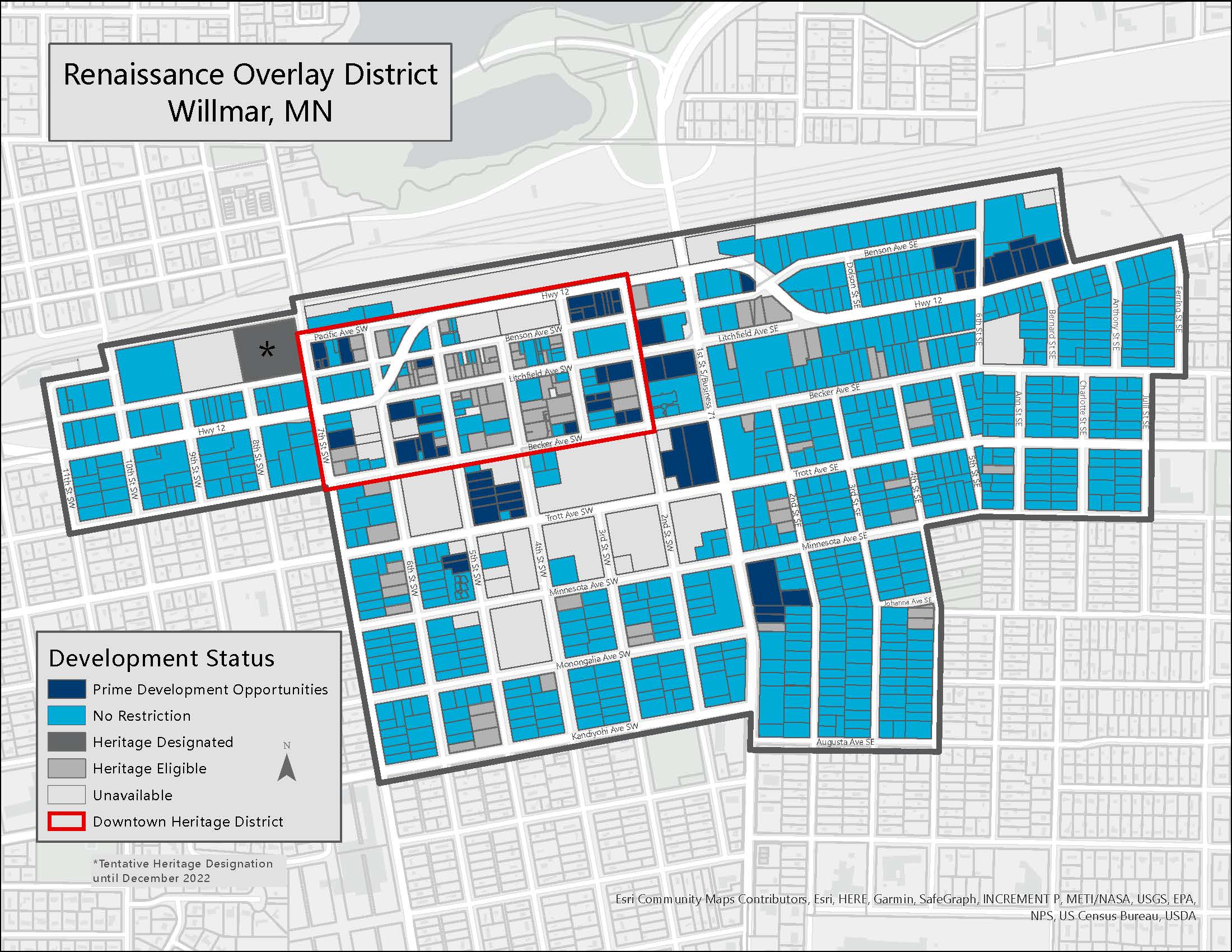

In an effort to entice more development for commercial and housing in the downtown area, the City of Willmar adopted a Renaissance Zone, which is a new zoning overlay district encompassing the Central Business District and adjacent areas.

The new Willmar Renaissance Zone is a five-year pilot program intended to encourage investment, job creation, development, creativity and vibrancy in the designated area. This district will offer greater flexibility relative to zoning requirements otherwise imposed by underlying zoning districts. Among the incentives offered in the Renaissance Zone are free permits (e.g. building permits, signage, sewer and water access charges); matching/forgivable loans for façade renovation; tax abatements for commercial and housing projects based upon meeting investment thresholds; and removal of holiday/weekend parking restrictions.

Kandiyohi County continues to be a leader in Greater Minnesota for business opportunities and workforce attraction. The Willmar Opportunity Zone Prospectus is a research-based document that can be used by interested investors who are entering the Opportunity Zone investing market. The Kandiyohi County Economic Development team are highly skilled and ready to work with you on an Opportunity Zone investment.

Taxes & Incentives

City and county government leaders work to keep local tax rates competitive—understanding that a healthy business community is vital for a strong economy. Government leaders balance the need for community services that make a community attractive with the tax rate to support them. Each government unit can use incentives for qualifying projects to encourage companies to invest and create jobs in the county. KCED staff can provide valuable leadership in analyzing projects to determine whether they meet incentive program qualifications and can develop finance models that benefit the business and the community.

Abatements may be a temporary forgiveness or deferral of local property tax. They can serve similar purposes as TIF as economic development tools, provided the local government finds that public benefits exceed the costs. Unlike TIF, under Tax Abatement, all government jurisdictions can opt in or opt out of projects.

Two ways to look at Tax Abatement:

- With new construction and valuation:

- New construction and value added to the tax base will generate new taxes.

- As long as the annual abatement doesn’t exceed the amount of new taxes generated, there is no cost to the taxpayer.

- The city recognizes tax increases and abatement amounts and budgets accordingly.

- Taxes on the original value are collected.

- Without any new construction or valuation:

- No added/tax generated; total levy amount decreases.

- If expenditures remain constant, the other taxpayers foot the bill due to the elevated costs.

Tax Increment Financing (TIF) uses the increased land property taxes that a new real estate development in a defined geographic area generates to offset eligible costs of the development. TIF is one of the most powerful tools in the economic development “toolbox.”

In Minnesota, TIF is used for two primary purposes:

- To induce or cause a development or redevelopment that otherwise would not occur.

- To finance public infrastructure (streets, sewer, water, or parking facilities) related to the development.

Different types of TIF districts include redevelopment, housing, economic development, and environmental remediation.

Tax Abatement Rates

|

Commercial/Industrial Value |

Payable 2024 City Tax* |

Annual Increase if City Abates $50,000 Tax* |

Annual Increase if City Abates $100,000 Tax* |

|---|---|---|---|

| $100,000 | $816 | $3.97 | $7.98 |

| $250,000 | $2,313 | $11.00 | $22.00 |

| $1,000,000 | $10,474 | $51.00 | $103.00 |

| $2,000,000 | $21,357 | $104.00 | $209.00 |

*Estimates based on 2024 data

The Tax Abatement/TIF application should be turned into the county or city where you are applying. KCED can assist in completing the application.

Major Employers

Our major employers include businesses throughout Kandiyohi County that employ over 50 people. These include the industries of hospitality, agriculture and agribusiness, manufacturing, construction, retail and wholesale, finance and insurance, information technology and telecommunications, logistics, healthcare, education and professional services.

Ready to unlock your full potential in Kandiyohi County?

Contact us now and let Kandiyohi County Economic Development be your gateway to success.